Do Indian Startups Have a Service Problem?

Indians are notorious for being paranoid about spending money online. Few people even have cards to pay online in this country, and fewer still like to use them, which means that cash truly is king. Although a growing cadre of companies such as FreeCharge and Paytm are boldly predicting the death of cash, the actual experience of using these services shows how far we have to go before they earn the trust needed to hold on to our money.

There are many reasons to actually use a virtual wallet – convenience, speed, and security being paramount – but the only reason that actually seems to click with people is cashbacks – that’s why FreeCharge, for instance, talks about pumping Rs. 2,000 crore as cashbacks to get people to try using the wallet. Paytm offers huge discounts on its e-commerce store (a rival CEO admitted that he bought his iPhone from Paytm because of the cashback offer) so that you will have a Paytm wallet flush with funds.

Startups are still working overtime to get users on board by any means possible, and you have to ask if this is diverting focus from delivering the best experience possible. That’s what leads to stories likeRocket Internet’s frequent CEO churn in India. But it’s one thing when the company that delivers your dinner appears unsecured. When it’s a company that holds your money, things look a little different.

For me, that’s exactly what happened. A week ago, my email started pinging overtime as I got five password reset requests from Paytm. Naturally, I clicked the button to inform Paytm, only to realise there was no live chat to resolve the issue. Instead, if someone is trying to engineer access to your account, then you have to send an email, and wait a day to get a response. There also doesn’t appear to be a customer care number that you can easily find on the website.

Is this behaviour that you would accept from HDFC or ICICI bank? With Paytm in line to be a payment bank itself, one has to ask the same questions.

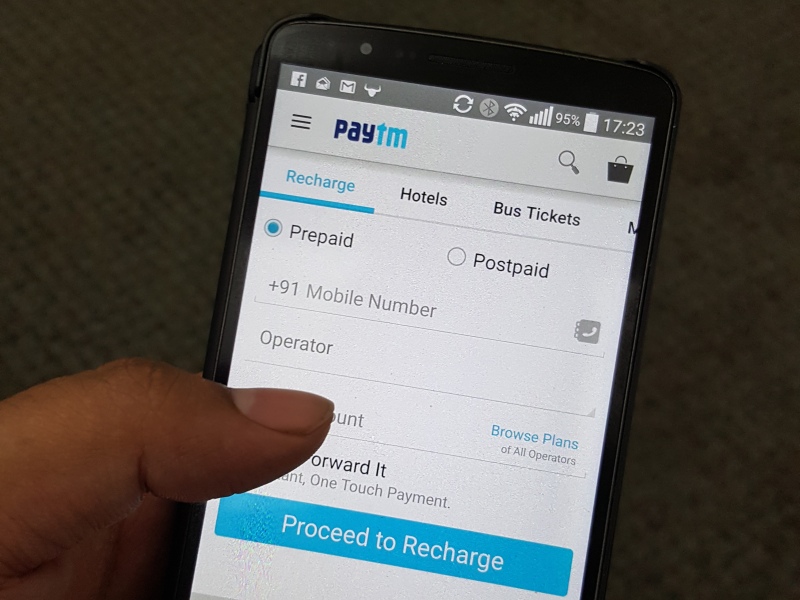

Later that day, I received another email from Paytm, stating that I had successfully recharged a Tata DoCoMo number. I own no such number. I once again contacted the company, this time stating that an unauthorised payment had been made in my name. Tweets were also shared to try and reach the company in some way that would yield a faster response.

Later that day, I received another email from Paytm, stating that I had successfully recharged a Tata DoCoMo number. I own no such number. I once again contacted the company, this time stating that an unauthorised payment had been made in my name. Tweets were also shared to try and reach the company in some way that would yield a faster response.

The same stock message followed, along with a confirmation that no money had been removed from my wallet. The other user didn’t have access to my Paytm account; but Paytm nonetheless thought that my email address was his.

Just to be safe, I remove the saved debit card information from Paytm and felt thankful that the wallet balance was under a rupee. There was no money to be lost but it seemed someone was still using my name to spend money on Paytm.

What if the person was to use his Paytm wallet to make a purchase which could be used for any illegal purpose? After all, the wallet enables peer to peer payments, which means it could be used in any way. And if a police check were to follow, they might link the payment to my email address instead of the person actually involved.

Is that a far-fetched scenario? Yes, but the point is that if my email address and phone number are already registered with Paytm, why is someone else being allowed to use the address at all?

The issue was repeated, and frustrated tweets finally got a response – from the CEO of the company, instead of customer care. I’ve interviewed Vijay Shekhar Sharma multiple times in the past, and enjoyed the experience. Here too, he was proactive, and told me he would take action. The results were immediate as well – Paytm connected on Twitter, and there were multiple calls, from the company’s customer care team, and its “cyber cell”.

The results of this experience were not exactly satisfactory. Both calls had different employees explain that while my email address is [email protected], the other user signed up with [email protected]. I repeatedly explained that as far as Google is concerned, these are the same thing, but it had no effect. Customer care also asked if I had ever shared my email address in public. Not the password, but the email address.

The results of this experience were not exactly satisfactory. Both calls had different employees explain that while my email address is [email protected], the other user signed up with [email protected]. I repeatedly explained that as far as Google is concerned, these are the same thing, but it had no effect. Customer care also asked if I had ever shared my email address in public. Not the password, but the email address.

Explaining that [email protected] also needs to be blocked by Paytm after [email protected] is assigned to an account also seemed to confuse both customer care and the cyber cell.

Eventually, Paytm promised to block the other user’s account. That user may well complain about being unfairly blocked and get unblocked at some point, restarting the cycle. But there is a bigger point to be made here.

Many Indian startups struggle with customer care. Everyone has a horror story about ordering dinner online, and finding out at 11PM that the restaurant claims it never got the order, and won’t be making a delivery. Equally prevalent are the number of stories you hear about budget hotel bookings that aren’t honoured, or rooms that appear to be nothing like the ones in photographs, with promised amenities missing.

In most such cases, the respective company’s top leadership will react quickly, and show commitment to customer satisfaction. We saw this with our own Paytm experience, and we’ve seen others such as Zomato’s Deepinder Goyal do this as well. But when the CEO is the first line of customer care that can effectively solve your problem, and not the last, it becomes a bit of an issue.

It can’t scale beyond a point, and while it’s wonderful to see a leader taking the time to engage with his users and remain aware of the customers’ reality, there is a desperate need for ground level workers to do a better job. This could call for better training and higher salaries, and companies might baulk at this expense (of time and money) but if there’s any long term thinking going on, then the value of this investment should be clear.

If we’re really not in a bubble, then companies need to focus more on getting the basics right, and not just on getting the most number of users.

[“source-ndtv”]